On 10 June 2020, the General Authority of Saudi Customs implemented an increase in the customs duty rates of more than 2000 tariff Lines of the KSA Integrated Customs Tariffs.

On initial review of the rise in import duties, the increase in customs duty levied on goods range from 0.5% to as high as 15% across categories. Importers must engage with a careful review of HSCodes/ classifications applied in customs data declarations to avoid incorrect costs/ penalties.

Our Europe, Asia and American freight forwarding partners shared exporters (as of last week) had not reported any potential marked declines in freight volumes to Saudi Arabia due to the increased import duties. The partners agreed that an overall rise in prices for local Saudi consumers and businesses will be felt when the Value Added Tax (VAT) rises from 5% to 15% on 1 July 2020.

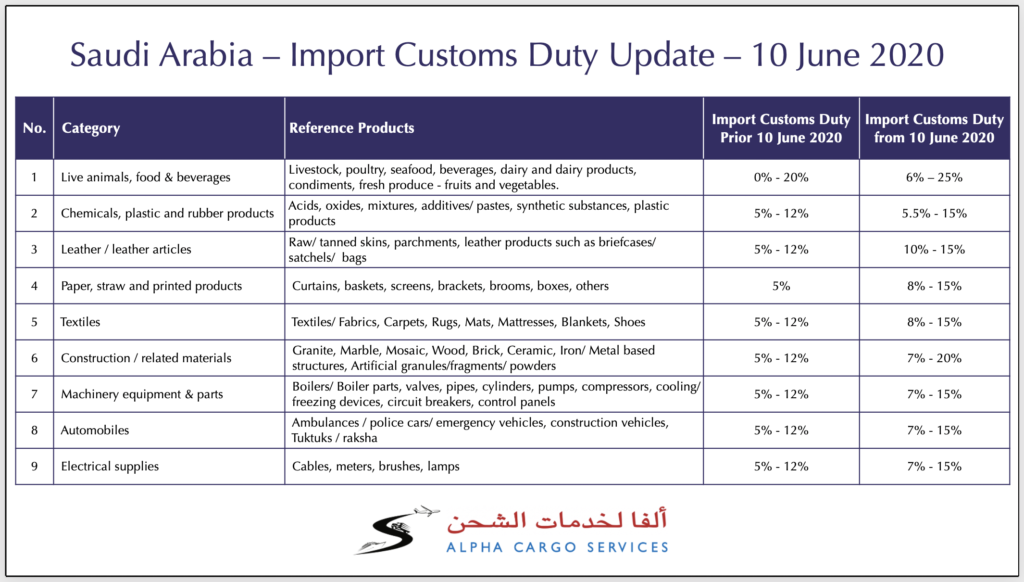

The brokerage team has compiled a summary of categories affected by the update, including some sample references of the import customs duty rate ranges prior 10 June 2020 and as of 10 June 2020.

Strategic use of available customs facilities such as customs exemptions, the customs duty suspension program, bonded warehouses, and free trade agreements may alleviate some of the increased costs on acquiring imported goods. The jury is out regarding the impact this rise in Saudi import customs duty may have on current GCC trade agreements.

Earlier in the year, we covered how Saudi Customs had introduced an online facility to allow Saudi importers to correct import customs data misdeclarations.

For more information on the applicable customs duty or assistance with import customs clearance in Saudi Arabia, please reach out to us.